Table Of Content

Discover Bank is both a full-service online bank and a payment services provider. Individuals can use Discover for banking and retirement planning. Discover is best known for its rewards credit cards, but it also offers checking account, savings accounts, money market accounts, CDs, and retirement products that are all FDIC insured.

Capital One is a well-known bank that developed a reputation mainly in the credit card industry. In fact, its most popular credit cards are not the only ones.

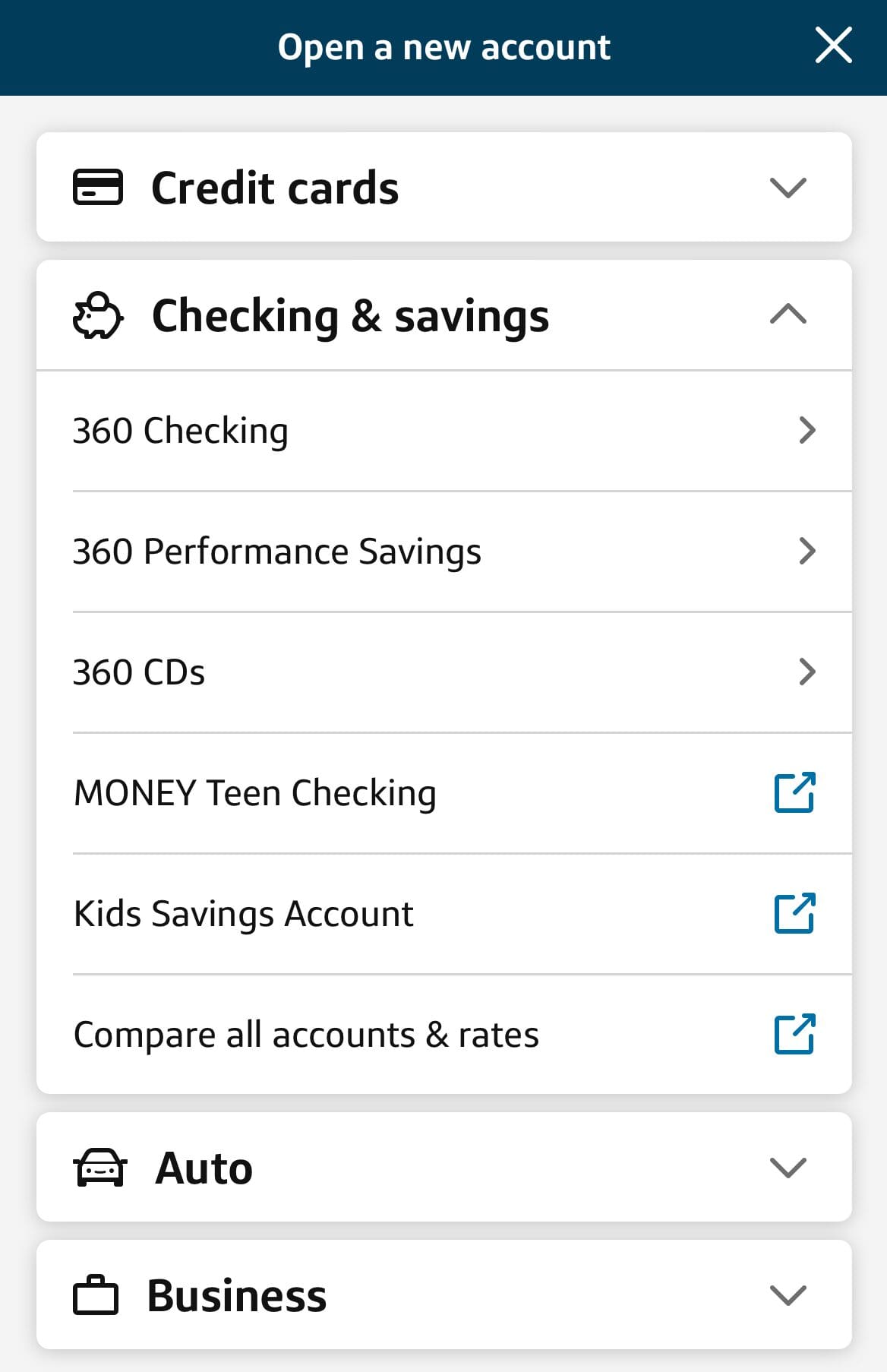

Capital One is an excellent banking option for people who prefer to do the majority of their banking online. There are enough account choices to appeal to a diverse group of people. Because there are few local branches, most banking is done online or through Capital One's mobile app.

Banking Options

Discover | Capital one | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

The Discover and Capital One savings accounts are very similar, with little to distinguish them apart. Both have the same rate and offer fee-free account maintenance. Both also have access to mobile tools to help you manage your money and work towards your savings goals.

Both accounts are included on our best savings accounts list for 2025.

The Capital One Kids Savings Account is designed to teach children about earning interest and the benefits of having a bank account, particularly one that isn't used as frequently as a checking account.

Discover | Capital one | |

|---|---|---|

APY | 3.70% | 3.70% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

Checking Needed? | No | No |

Main Benefits |

|

|

Checking Account

There are more differences between the Discover and Capital One checking accounts. Firstly, while Discover offers cash back on your debit card purchases, Capital One provides interest on your account balance of 0.1%.

Although this is less than the Discover cashback rate of 1%, you don’t need to use your debit card or take any action to receive the interest on your funds.

So, if you primarily use your account for paying bills or making transfers rather than using your debit card, it is likely to provide more.

While both Discover and Capital One have a mobile app to help you manage your account, Capital One has a larger ATM network, which could be more beneficial.

Additionally, you can access in person help from ambassadors at cafes and other Capital One locations.

Discover | Capital one | |

|---|---|---|

APY | 0% (1% cash back on up to $3,000 in debit card purchases each month) | 0.10% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $50 |

Main Benefits |

|

|

CDs

Where Capital One really stands apart is with its CDs. In addition to having no minimum deposit, you can access better rates. Discover CD rates are a bit lower, but the minimum is higher.

So, unless you have $2,500+ and only want to tie your money up for just one year, Capital One is a better choice.

Capital One | Discover | |

|---|---|---|

Minimum Deposit | $0 | $2,500 |

APY Range | 3.50% – 4.00% | 2.00% – 4.00% |

APY 6 months | 3.80% | 3.70% |

APY 12 months | 4.00% | 4.00% |

APY 24 months | 3.50% | 4.10% |

APY 36 months | 3.50% | 3.50% |

No Penalty CD | / | / |

Credit Cards

Discover has a decent variety of credit card options that offer rewards on your purchases. The Discover Cash Back card offers up to 5% cash back, while the Travel Card offers miles and the Gas & Restaurant card offers 2% in this category.

There is also a NHL card for all 31 teams. Discover also has student cards that offer up to 5% cash back or if you have less than perfect credit, there is the Discover Secured card to earn cash back as you rebuild your credit.

All the Discover credit cards also have Unlimited Cashback Match for your first year.

Capital One offers an extensive selection of credit card options, and you can browse the cards according to category, rate, and credit rating.

Even with fair credit, you can earn 1.5% cash back unlimited with the QuicksilverOne Rewards.

Personal Loans

Discover personal loans are versatile, covering debt consolidation, home improvements, or major expenses like weddings.

These unsecured loans require no collateral and offer competitive APRs, though the best rates require excellent credit.

Discover pays creditors directly for debt consolidation and offers a 30-day money-back guarantee. No origination or prepayment fees apply, but late payments incur a $39 fee.

Discover | |

|---|---|

APR | 7.99% – 24.99%

|

Loan Amount | $2,500 – $40,000

|

Terms | 36 to 84 months

|

Customer Service

Discover offers 24/7 customer support via phone or online chat. You can also access the support team via the Discover app.

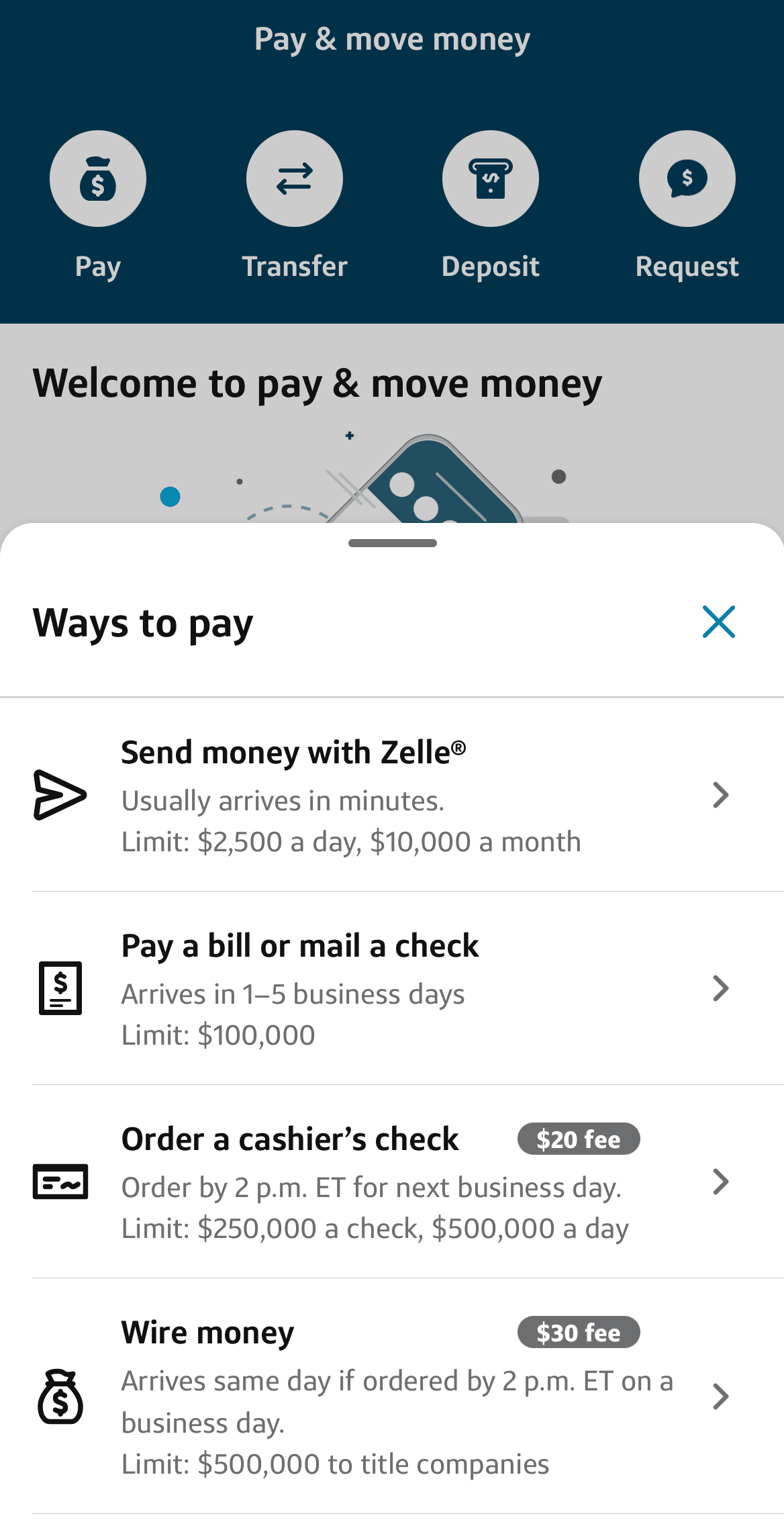

Capital One’s support is a little more complex. The bank has dedicated phone lines according to your specific issue. So, if you have a credit card query, you’ll need a different line compared to those with a savings account issue.

You can access the support page on the Capital One website and click on the appropriate link to access the phone number and details about when the service team is available. There is also a mailing address or you can tweet @AskCapitalOne.

Online/Digital Experience

Both Discover and Capital One have apps to enhance the customer’s digital experience. Discover’s app is available for iOS and Android with a rating of 4.9/5 and 4.6/5 respectively on the Apple Store and Google Play. The Capital One mobile app is rated 4.8/5 and 4.9/5 on Apple and Google.

Both apps allow you more control over your account, with 24/7 access to manage your transactions, make transfers, lock your card and receive notifications.

As we touched on above, Capital One has an impressive website that allows you to not only compare card and account options but also access resources to help you improve your finances and discover the best products for your specific needs and circumstances.

Which Bank is The Winner?

With both banks offering similar products, we need to look a little more closely at which bank is better.

In most cases, Capital One is a better choice for CDs. While Discover has a minimum deposit of $2,500, Capital One has no minimums. Additionally, apart from the one year CD, where Discover offers a better rate, Capital One has higher rates.

Capital One also has a wider variety of credit card options. So, overall, it does appear to be the better bank.

FAQs

What promotion does Capital One offer?

Currently, there is no promotion bonus for Capital One bank account.

However, since it has its background in credit cards, it stands to reason that Capital One would tend to favor credit card promotions for new customers. New cardholders can qualify for bonus offers and rewards if they meet some basic criteria.

For example, if you have excellent credit, the Venture X Rewards card offers 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening.

What promotion does Discover offer?

Discover offers checking account promotions for new accounts as well as on a variety of credit cards. As of June 2025 , Discover Online Savings offers N/A bonus promotion based on your minimum deposit. There are also promotions on Discover Cashback Debit Account

Is Discover ready for recession?

On the surface, Discover is a well-known brand with a lengthy history and high profits in the recent years. In 2008, the bank has endured difficult financial circumstances. Discover was able to repay these funds by 2010 even after the financial crisis of 2007–2008, when the bank received $1.2 billion in federal bailout funding.

Naturally, Discover is also FDIC insured, so even if the bank experiences financial difficulties, you can be confident that your deposits up to $250,000 are protected by federal insurance.

Can I deposit a check online?

Both Discover and Capital One make it simple to deposit paper checks. Both use a mobile app that allows you to easily track your spending, transfer money, and deposit paper checks. These are Discover's exclusive features, which are just a few of the many features available to their customers.

All Mobile Deposits are FDIC insured up to the same amount as any other deposit into your account. Mobile Deposit is a free service that allows you to deposit checks into Capital One & Discover eligible checking and savings accounts.

Does Capital One offers auto loan?

Capital One does, in fact, offer auto refinancing. Car loans from Capital One Auto are available with terms ranging from 36 to 72 months. Capital One Auto Finance does not require an initial hard credit inquiry. This means you can pre-qualify for a refinance without affecting your credit score. Capital One Auto Finance may be available to applicants with credit scores ranging from 550 to 850. The eligibility age is 18 or the state minimum, whichever is higher.

Applicants must have a minimum annual income of $18,000 or higher to qualify for auto loans with Capital One Auto Finance.

How's Discover student loans work?

Discover student loans are an excellent backup option for students whose federal loan is insufficient to cover all of their college expenses. Discover also provides refinancing options if you want to reduce your repayment burden.

Discover does not charge any processing fees, their interest rates are low and highly competitive, and they offer their customers deferment and forbearance.

When you apply for a Discover loan for the first time, the company will check your credit report to ensure that you have an excellent score. If your credit score is insufficient, you will not be eligible for the loan; however, you may have a parent co-sign the loan with you.

Undergraduate loans have a 15-year repayment period with a 6-month grace period. This means that if you are a student, you will not be required to begin repaying your loan until six months have passed.

How Do Discover Points Rewards Programs Work?

While many card companies offer point rewards, Discover currently has only one card that does not offer a percentage cash back. This is the Discover It Travel card, which provides Air Miles rather than a percentage of cash back.

This works in the same way as cash back offers. Instead of receiving a percentage of your purchases, you will receive 1.5 miles for every dollar spent. There are no restrictions on the number of miles you can accumulate.

You can earn miles and then redeem them for statement credit or cash toward a travel purchase. With no blackout dates, your miles can help you with the cost of your trips and travel. This allows you to cover expenses such as airfare, hotels, and even gas station purchases.

Discover vs Capital One: Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked at Capital One and Discover in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Capital One With Other Banks

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

CIT Bank offers a variety of savings accounts. Savings Connect has two tiers, with the first offering a higher rate if you make qualifying deposits and link your checking account. Savings Builder, on the other hand, offers 3.99 percent if you keep a balance of $25,000 or make monthly deposits of at least $100. There are no account maintenance fees, but you can only make six transactions per statement cycle.

Capital One offers a high yield savings account with a slightly lower rate than CIT Bank's top rate. However, you are not required to jump through any hoops. The account allows six withdrawals per calendar month, but there is no minimum deposit or balance requirement to keep your account open.

Read Full Comparison: CIT Bank vs Capital One: Which Bank Account Is Better?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

Bank of America has an impressive product lineup, as one would expect from a large banking institution. There are various checking and savings accounts, as well as numerous credit card options, auto loans, home loans, and investments. This makes switching from your current bank a breeze.

Capital One began as a credit company, but it has recently expanded its product line. You can now access checking and savings accounts, auto finance, refinancing, and children's accounts in addition to an impressive selection of credit cards.

Read Full Comparison: Bank of America vs Capital One: Which Bank Wins?

Picking the right bank account can be confusing, especially when looking at big banks like U.S. Bank and Capital One. Here's our winner: U.S. Bank vs. Capital One

Capital One is our winner as it offers a full banking package. But if you have specific checking requirements, M&T Bank may win. Here's why.

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

Regions Bank has physical branches you can visit, while Capital One operates mainly online. Let's compare their banking products: Regions Bank vs. Capital One

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

Capital One is our winner as it is a better fit for most consumers, while HSBC banking products are designed for high-net-worth individuals.

Capital One is our winner for most consumers than Barclays bank. But, there are important things to consider when comparing them: Barclays Bank vs. Capital One

Capital One is our winner with a full banking package, including a decent checking option, high savings rates, and great credit cards.

Banking Reviews

Aspiration Review

Alliant Credit Union Review